A busy week for pensions and retiree policy

Date Posted: 9/20/2024 | Author: Heather Sheffield and Monty Exter

There’s a lot of news to cover concerning educators’ retirement benefits this week. In addition to a Teacher Retirement System (TRS) board meeting that was still ongoing at the time of this post and will be reported on next week, TRS delivered its legislative appropriations request (LAR) to the Legislative Budget Board, the House Pensions, Investments, and Financial Services (PIFS) Committee met, and there was activity on the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) at the federal level.

TRS appropriations request

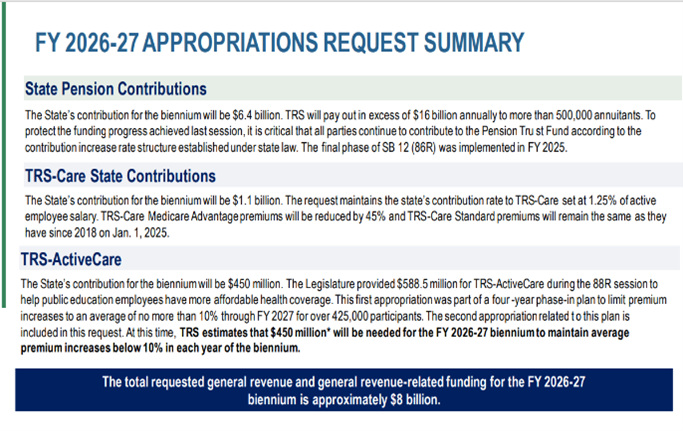

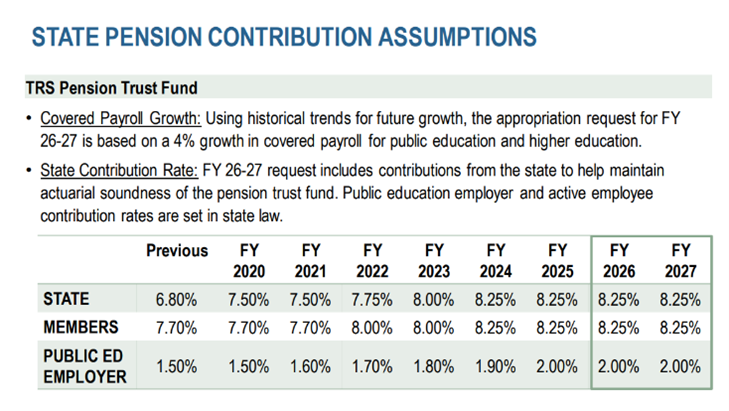

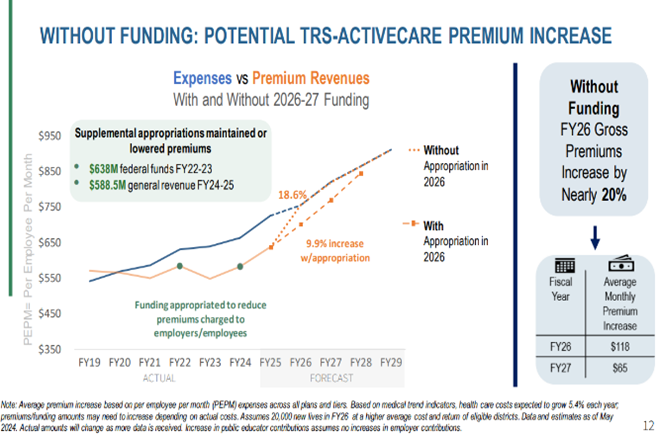

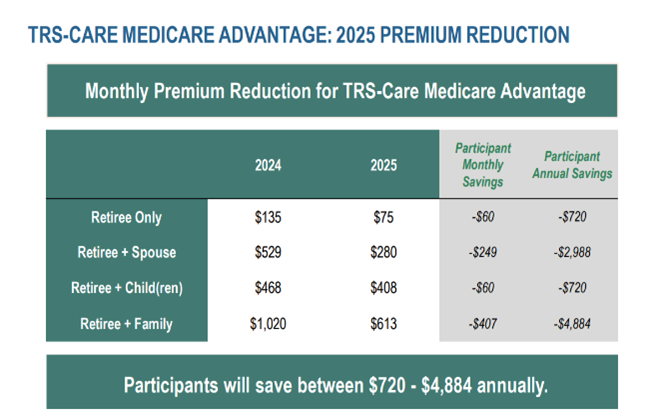

On Wednesday, TRS Executive Director Brian Guthrie presented the agency’s appropriations request for the upcoming biennium to the Legislative Budget Board (LBB). Guthrie gave a summary on the TRS pension trust fund and went over the fiscal year 2026-27 appropriations request summary, which includes information on state pension contributions, state TRS-Care contributions, and TRS-ActiveCare. He shared that without state funding for the next biennium, plan participants will experience potential TRS-Active Care premium increases of approximately 20%. TRS is asking the state for approximately $450 million to ensure that premium increases do not exceed 10%. Below are a few of the slides provided to the Legislative Budget Board.

House PIFS Committee

On Thursday, the House PIFS Committee held an interim hearing to review a slew of committee charges related to various state and local pensions and trust funds and associated investment practices. Among the charges was monitoring of Senate Bill (SB) 10, 2023 legislation that provided both a cost-of-living-adjustment (COLA) and a one-time supplemental payment to many Texas retired teachers. ATPE Director of Governmental Relations Monty Exter testified, thanking the committee for the passage of SB 10; relaying ATPE’s recognition that the Texas House had actually approved an even bolder plan that would have, in addition to the current COLA, put into place a modest automatic annual COLA; expressing our hope that the House proposal would be brought up again in the upcoming session; and discussing limitations and potential solutions to the funding barriers facing the TRS pension fund.

WEP/GPO Social Security reform

Authors of a federal bill in the U.S. House of Representatives to eliminate the WEP and GPO successfully began a procedural move to force a floor vote on the measure and were able to collect 219 signatures from their follow House members to do so in a matter of a few days. Despite this move, the proximity to the end of the congressional calendar and the election make the path for bill passage challenging. ATPE fully supports efforts to address the WEP and GPO, which unfairly and arbitrarily reduce the Social Security benefits of public servants, including many Texas educators. We will continue to actively engage in and report on these efforts.

CONVERSATION

RECOMMENDED FOR YOU

02/27/2026

Teach the Vote’s Week in Review: Feb. 27, 2026

SBOE approves 4,200 edits and corrections to Bluebonnet Learning instructional materials. Plus: Election Day is Tuesday, March 3.

02/27/2026

SBOE special-called meeting highlights philosophical divides

The Texas State Board of Education met for a full day on February 25th in a special-called meeting.

02/24/2026

Get out and early vote this week for important statewide offices

It’s time to Teach the Vote in the races for Texas governor, lieutenant governor, attorney general, and comptroller.