TRS board discusses annual actuarial valuation and policy and rate changes

Date Posted: 12/06/2024 | Author: Heather Sheffield

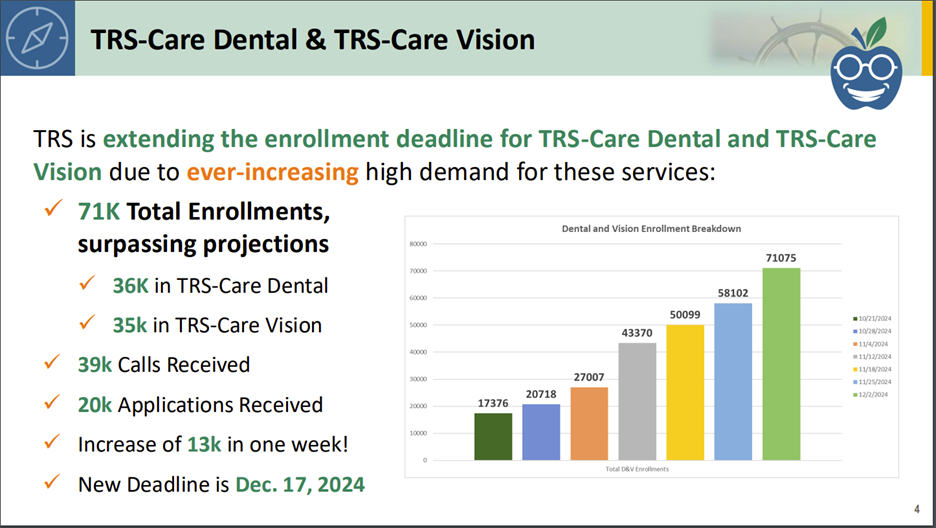

The Teacher Retirement System (TRS) Board of Trustees met Dec. 5–6 in Austin. Trustees honored outgoing chair Jarvis V. Hollingsworth by approving a resolution recognizing his service. In addition, Executive Director Brian Guthrie announced that due to higher-than-expected demand for new TRS-Care Dental and TRS-Care Vision options, TRS has extended the enrollment deadline for these plans until Dec. 17.

The most substantive work was done by the Policy Committee to adopt proposed amendments and repeal language dealing with member engagement and contested cases. The full board received the TRS Pension Trust Fund Actuarial Valuation and the TRS-Care Actuarial Valuation and Other Post-Employment Benefits (OPEB) reports for the fiscal year ending Aug. 31, 2024.

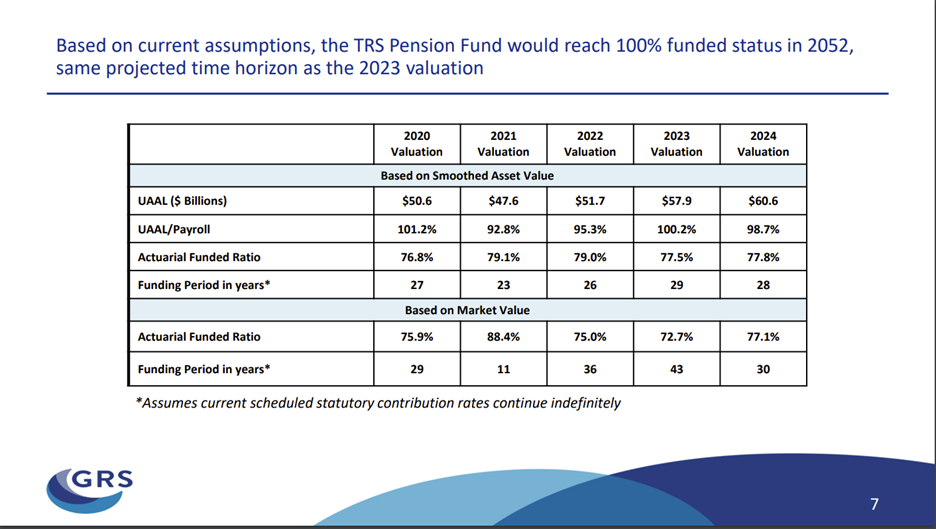

The actuarial valuation prepared as of Aug. 31, 2024, is a “health checkup” for the TRS pension fund to determine the adequacy of current statutory contributions, explain changes in actuarial condition, track changes over time, warn about possible future problems, and provide an annual comprehensive financial report. While the report shows that employer contributions toward retirement for Texas public educators are among the lowest when compared with employer contributions across the nation, and salary increases of approximately 5.7% over the past five years have outpaced the current assumptions (projecting larger benefits and liabilities, which increases the fund’s Unfunded Actuarial Accrued Liability (UAAL) by $1.5 billion more than expected), the funding period remains on track from last year’s expectation. (The UAAL is the shortfall between the actuarial value of the pension fund’s assets and the actuarially determined liabilities for future retirement benefits—in other words, how much the system needs to pay out future benefits that is currently doesn’t have.)

As previously reported, TRS has asked the Legislature to approve $450 million in appropriations to cover expenses to keep the average gross premium rate increases below 10% each year through 2027. If the Legislature does not approve this request, premiums for TRS-ActiveCare (health care for active employees) are likely to increase approximately 20% and educators will be forced to pay approximately $2,196 more by 2027. No premium changes are proposed for TRS-Standard (health care for retired educators not yet eligible for Medicare) at this time. Due to a growing fund balance, funding changes to Medicare benefits and funding at the federal level, and thorough fund management by TRS, premiums for TRS-Medicare Advantage (health insurance for retired TRS members who are eligible for Medicare) will be reduced, but the reductions will only be applicable to Medicare-eligible participants. With a new administration coming in January, TRS will continue to monitor changes in federal laws and regulations. Any changes at the federal level may require potential plan changes in the future. ATPE will continue to report on any changes.

Click here to review the entire TRS board meeting book for more information.

CONVERSATION

RECOMMENDED FOR YOU

02/27/2026

Teach the Vote’s Week in Review: Feb. 27, 2026

SBOE approves 4,200 edits and corrections to Bluebonnet Learning instructional materials. Plus: Election Day is Tuesday, March 3.

02/27/2026

SBOE special-called meeting highlights philosophical divides

The Texas State Board of Education met for a full day on February 25th in a special-called meeting.

02/24/2026

Get out and early vote this week for important statewide offices

It’s time to Teach the Vote in the races for Texas governor, lieutenant governor, attorney general, and comptroller.