TRS: fiscal year wrap and looking forward to session

Date Posted: 10/28/2016 | Author: Monty Exter

The 2016 fiscal headline for the Teacher Retirement System (TRS): the fund continues to beat expectations.

TRS fund managers brought in $11 billion this year bringing the total fund assets to $132.7 billion. The one year rate of return was 7.38 percent, which is just shy of the long term eight percent expected rate of return. Still, it’s considerably better than last year's percentage and a very good rate of return considering the 2016 market.

As a result of Senate Bill 1458 passed in 2013, TRS went through some major design changes, including changes in retirement age and funding rates. The bill was designed to dramatically improve the long-term health of the fund and move it toward being a fully funded pension system. As part of that long-term plan, there was an expectation that unfunded liabilities would increase slightly before beginning to decrease substantially.

As expected, the pension's unfunded liability has moved from $33 to $35 billion and its expected funding date from 33 years to 33.9 years. The expectation at this point in the life cycle of the current plan was that the funding date would be closer to 36 years, which again points to the plan outperforming expectations.

The funded ratio has gone from 80 percent to 79.7 percent. While this slight decrease was fully expected, many of the board members lamented the drop below 80 percent, which is considered a psychological benchmark for the board as it relates to common perceptions of pension fund health. The staff projects that the fund will be back above the 80 percent threshold within approximately seven years.

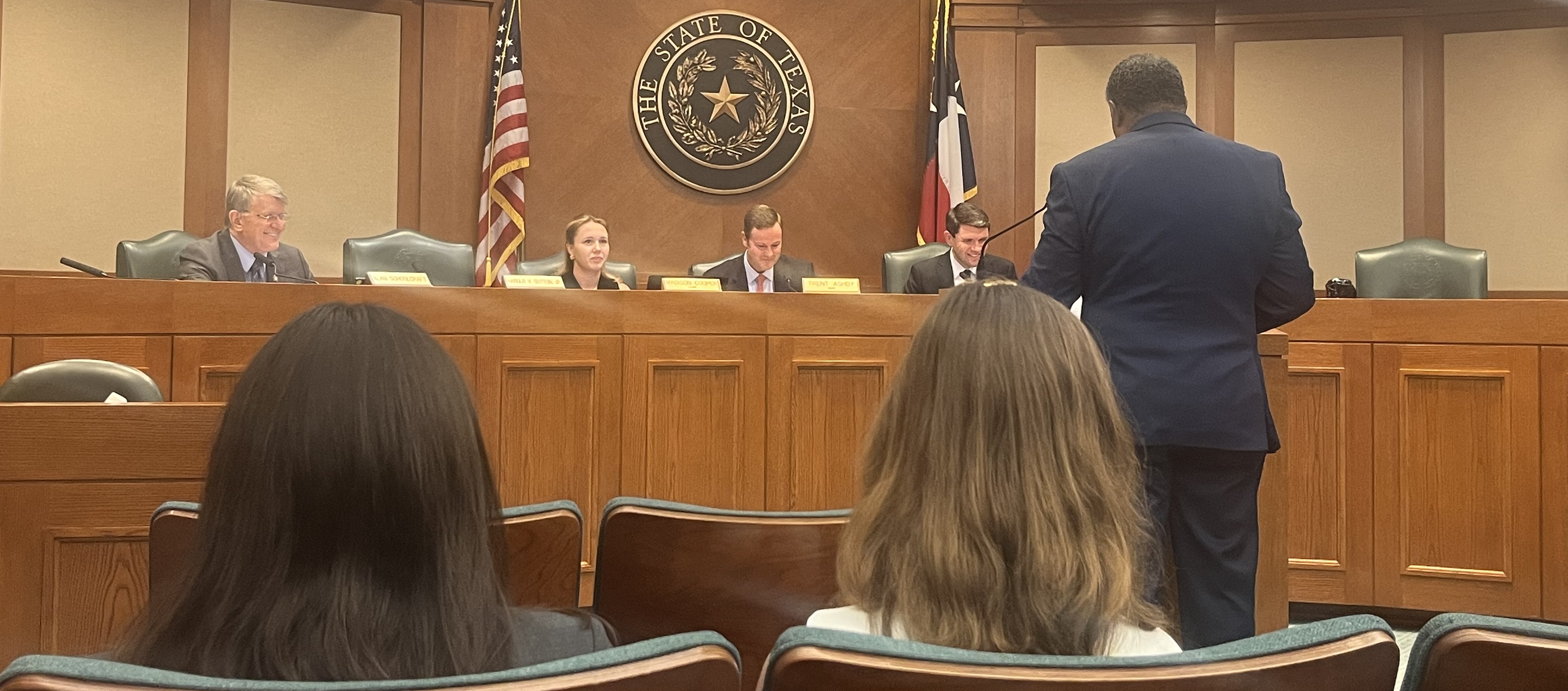

TRS Executive Director Brian Guthrie previews some of the agency's legislative goals at yesterday’s board meeting: the TRS proposed omnibus bill for the 85th Legislative Session.

Each session TRS drafts a bill designed to take care of statutory inconsistencies, address the agency's current needs, and streamline its statutory framework. Some sessions the bill is more significant than others. With SB 1458 only two sessions behind us and the agency going into sunset review (a process that essentially amounts to an audit of the agency and one that all state agencies undergo on a scheduled basis) in the 2019 legislative session, this year’s bill is expected to be fairly light. TRS staff shared four primary recommendations covered by the draft bill with the board:

The 2016 fiscal headline for the Teacher Retirement System (TRS): the fund continues to beat expectations.

TRS fund managers brought in $11 billion this year bringing the total fund assets to $132.7 billion. The one year rate of return was 7.38 percent, which is just shy of the long term eight percent expected rate of return. Still, it’s considerably better than last year's percentage and a very good rate of return considering the 2016 market.

As a result of Senate Bill 1458 passed in 2013, TRS went through some major design changes, including changes in retirement age and funding rates. The bill was designed to dramatically improve the long-term health of the fund and move it toward being a fully funded pension system. As part of that long-term plan, there was an expectation that unfunded liabilities would increase slightly before beginning to decrease substantially.

As expected, the pension's unfunded liability has moved from $33 to $35 billion and its expected funding date from 33 years to 33.9 years. The expectation at this point in the life cycle of the current plan was that the funding date would be closer to 36 years, which again points to the plan outperforming expectations.

The funded ratio has gone from 80 percent to 79.7 percent. While this slight decrease was fully expected, many of the board members lamented the drop below 80 percent, which is considered a psychological benchmark for the board as it relates to common perceptions of pension fund health. The staff projects that the fund will be back above the 80 percent threshold within approximately seven years.

TRS Executive Director Brian Guthrie previews some of the agency's legislative goals at yesterday’s board meeting: the TRS proposed omnibus bill for the 85th Legislative Session.

Each session TRS drafts a bill designed to take care of statutory inconsistencies, address the agency's current needs, and streamline its statutory framework. Some sessions the bill is more significant than others. With SB 1458 only two sessions behind us and the agency going into sunset review (a process that essentially amounts to an audit of the agency and one that all state agencies undergo on a scheduled basis) in the 2019 legislative session, this year’s bill is expected to be fairly light. TRS staff shared four primary recommendations covered by the draft bill with the board:

- Clarify statutes relating to certain plan terms, electronic communication with participants, IRS plan qualification & compliance, and reporting deadlines from reporting entities.

- Correct statutory references from the TRS Board of Trustees to the Higher Education Coordinating Board regarding certifying contributions to Optional Retirement Fund.

- Remove the requirement in the Education Code that the TRS Board of Trustees determine whether a school district offers group health coverage that is comparable to TRS Active-Care.

- Clarify statute to ensure that additional and enhanced personal financial information required by the TRS Board of Trustees provided by key employees is not subject to public disclosure.

CONVERSATION

RECOMMENDED FOR YOU

04/24/2025

Subcommittee on Academic and Career-Oriented Education holds quick meeting on two bills

HB 1209 by Rep. Charles Cunningham (R–Kingwood) is designed to prohibit schools from adopting four-day school weeks.

04/23/2025

House Public Education Committee tackles recapture bills

The House Public Education Committee met Tuesday for the first time since passage of school finance and voucher legislation April 16 and 17.

04/21/2025

Make your plan to vote in the May 3 election

School board seats plus bond propositions may be on your ballot. Early voting runs April 22–29, and Election Day is May 3.