From The Texas Tribune: A tight-fisted Texas Legislature with expensive ambitions

School Finance Texas Legislature

Date Posted: 12/06/2018

"Analysis: A tight-fisted Texas Legislature with expensive ambitions" was first published by The Texas Tribune, a nonprofit, nonpartisan media organization that informs Texans — and engages with them — about public policy, politics, government and statewide issues.

The Texas Legislature’s strong allergy to tax increases might be abating — just as long as you don’t call them tax increases.

They’re not saying so out loud — no point in riling up a price-sensitive electorate before the holidays, before the upcoming legislative session — or before lawmakers are ready to make their sales pitch.

But the talk of school finance as a top legislative priority guarantees a conversation about taxes. While there are many great policy reasons to mess with that persistent and gnarly issue, the political motivation here is simple: Texas property owners have made it clear to their representatives that they want lower property taxes.

When you do hear lawmakers talking about tax increases next year — whatever euphemisms they choose — they’ll be talking in terms of how that money will pay for property tax cuts. Cutting everyone’s current most-hated tax is the only way to explain so many conservative legislators making serious noises about increasing state revenue.

Given the way the state pays for public education — with a combination of local property taxes, and state and federal funding — the only ways to lower property taxes are to cut public education spending or to find money elsewhere to offset property tax cuts.

In the state’s 2019 fiscal year, the local share of school finance spending is estimated to be 55.5 percent of the total, while the state’s share is expected to be 35 percent, according to the Legislative Budget Board. The rest comes from the federal government.

The last time the Texas Legislature tackled school finance, the local and state shares matched. Years of rising property values – and rising local property tax revenue with them – have allowed the state to lower its share.

The price tag for a rebalancing would be enormous, though. And in spite of Democratic gains in last month’s elections, Texas still has a Republican-dominated state government, with GOP majorities in both the House and Senate, and Republicans in every statewide office. Many of them got where they are by opposing anything that sounded like higher taxes, which makes the road ahead pretty interesting.

If you do some quick arithmetic on those 2019 estimates, it would take a $5.7 billion increase in annual state spending to rebalance the state and local shares of public education spending. Doing that would put them both back where they were in 2008 — each covering about 45 percent of the load.

That’s easier to do on the back of an envelope than it is to do in the Legislature. The budget ahead is tight. House and Senate leaders have to pass what’s called a “supplemental appropriations bill” to take care of shortages in the current budget, Hurricane Harvey recovery costs, and so on. Early guesstimates are that they’ll start more than $5 billion short of what they need for the next budget — and that’s before they even bring up the expensive school finance project.

The governor already is circulating a document that dares to mention taxes in the title: “Improving Student Outcomes and Maintaining Affordability through Comprehensive Education and Tax Reforms.”

That gets right to the politics of the situation: State leaders are interested in easing property tax burdens, and school finance is the biggest lever in their toolkit. It’s also way out of balance and happens to need fixing. Lawmakers often blame the imbalance on school funding formulas. But they’re the authors of those dreaded formulas, and this is also a chance to put something better in place.

But it’s the tax problem — the price of owning property — that has made their price-sensitive voters potentially receptive to increases in other taxes. New money could come from eliminating exemptions, from property appraisal reforms, from raising existing tax rates or creating new taxes — any number of things. They’ll decide the details when they meet. They’ll figure out what to call it, too: It might be remarkable to see “tax” in the title of the governor’s presentation, but its neighboring word — “reform” — is the political touch.

They want to lower property taxes to make their voters happy, and to accomplish that expensive task without stirring up a new revolt from a different set of taxpayers.

At the end, someone in Texas has to pay for this stuff.

This article originally appeared in The Texas Tribune at https://www.texastribune.org/2018/12/03/tight-fisted-texas-legislature-school-finance-property-tax/.

Texas Tribune mission statement

The Texas Tribune is a nonprofit, nonpartisan media organization that informs Texans — and engages with them — about public policy, politics, government and statewide issues.

CONVERSATION

RECOMMENDED FOR YOU

04/03/2025

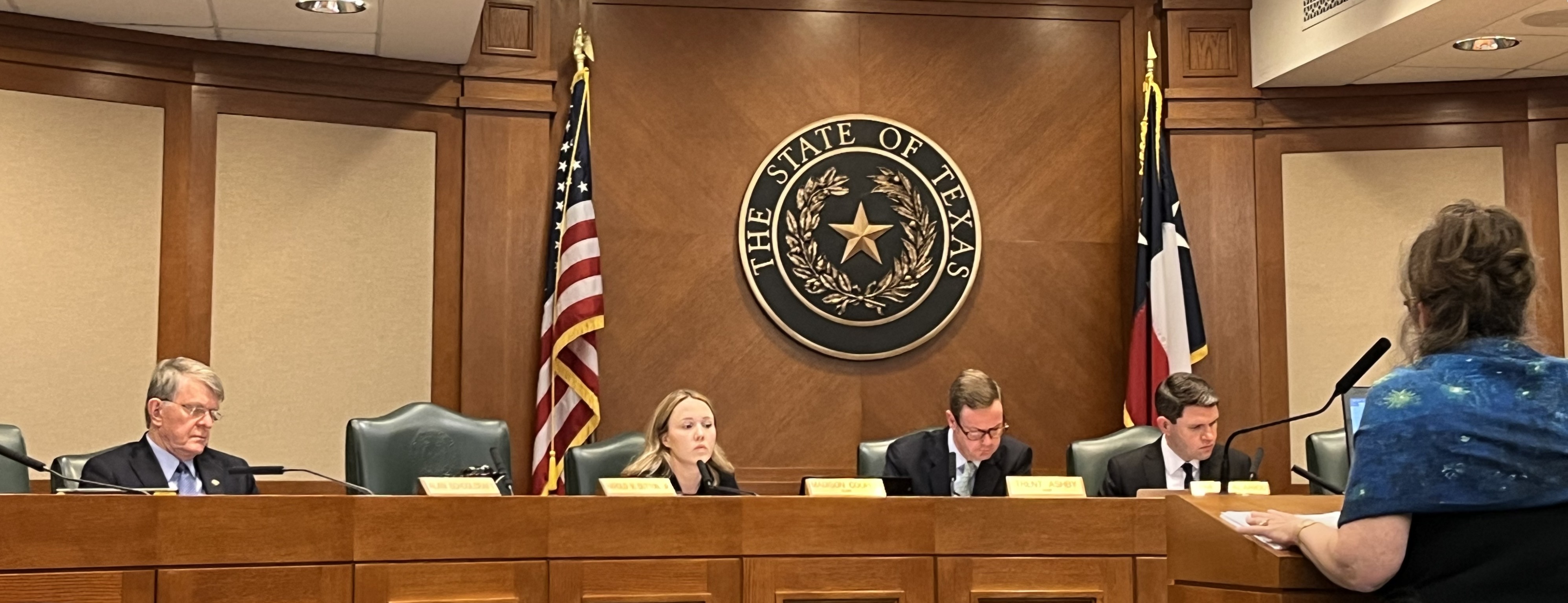

House Public Education Subcommittee hears bills on bilingual education, civics instruction, antisemitism

The Subcommittee on Academic and Career-Oriented Education met Thursday, April 3, to consider five bills.

04/02/2025

House Public Education Committee postpones vote on school finance, vouchers to Thursday

Educators have additional time to use ATPE’s Advocacy Central to share their thoughts on these critical issues.

04/02/2025

Senate Education K-16 Committee hearing goes late into the night

ATPE weighed in on several bills heard during the committee’s April 1 hearing.